Bollinger Bands¶

- This example is based on:

from __future__ import print_function

from quantworks import strategy

from quantworks import plotter

from quantworks.tools import quandl

from quantworks.technical import bollinger

from quantworks.stratanalyzer import sharpe

from quantworks import broker as basebroker

class BBands(strategy.BacktestingStrategy):

def __init__(self, feed, instrument, bBandsPeriod):

super(BBands, self).__init__(feed)

self.__instrument = instrument

self.__bbands = bollinger.BollingerBands(feed[instrument].getCloseDataSeries(), bBandsPeriod, 2)

def getBollingerBands(self):

return self.__bbands

def onOrderUpdated(self, order):

if order.isBuy():

orderType = "Buy"

else:

orderType = "Sell"

self.info("%s order %d updated - Status: %s" % (

orderType, order.getId(), basebroker.Order.State.toString(order.getState())

))

def onBars(self, bars):

lower = self.__bbands.getLowerBand()[-1]

upper = self.__bbands.getUpperBand()[-1]

if lower is None:

return

shares = self.getBroker().getShares(self.__instrument)

bar = bars[self.__instrument]

if shares == 0 and bar.getClose() < lower:

sharesToBuy = int(self.getBroker().getCash(False) / bar.getClose())

self.info("Placing buy market order for %s shares" % sharesToBuy)

self.marketOrder(self.__instrument, sharesToBuy)

elif shares > 0 and bar.getClose() > upper:

self.info("Placing sell market order for %s shares" % shares)

self.marketOrder(self.__instrument, -1*shares)

def main(plot):

instrument = "yhoo"

bBandsPeriod = 40

# Download the bars.

feed = quandl.build_feed("WIKI", [instrument], 2011, 2012, ".")

strat = BBands(feed, instrument, bBandsPeriod)

sharpeRatioAnalyzer = sharpe.SharpeRatio()

strat.attachAnalyzer(sharpeRatioAnalyzer)

if plot:

plt = plotter.StrategyPlotter(strat, True, True, True)

plt.getInstrumentSubplot(instrument).addDataSeries("upper", strat.getBollingerBands().getUpperBand())

plt.getInstrumentSubplot(instrument).addDataSeries("middle", strat.getBollingerBands().getMiddleBand())

plt.getInstrumentSubplot(instrument).addDataSeries("lower", strat.getBollingerBands().getLowerBand())

strat.run()

print("Sharpe ratio: %.2f" % sharpeRatioAnalyzer.getSharpeRatio(0.05))

if plot:

plt.plot()

if __name__ == "__main__":

main(True)

this is what the output should look like:

2011-07-20 00:00:00 strategy [INFO] Placing buy market order for 74183 shares

2011-07-20 00:00:00 strategy [INFO] Buy order 1 updated - Status: SUBMITTED

2011-07-21 00:00:00 strategy [INFO] Buy order 1 updated - Status: ACCEPTED

2011-07-21 00:00:00 broker.backtesting [DEBUG] Not enough cash to fill yhoo order [1] for 74183 share/s

2011-07-21 00:00:00 strategy [INFO] Buy order 1 updated - Status: CANCELED

2011-07-21 00:00:00 strategy [INFO] Placing buy market order for 73583 shares

2011-07-21 00:00:00 strategy [INFO] Buy order 2 updated - Status: SUBMITTED

2011-07-22 00:00:00 strategy [INFO] Buy order 2 updated - Status: ACCEPTED

2011-07-22 00:00:00 broker.backtesting [DEBUG] Not enough cash to fill yhoo order [2] for 73583 share/s

2011-07-22 00:00:00 strategy [INFO] Buy order 2 updated - Status: CANCELED

2011-07-25 00:00:00 strategy [INFO] Placing buy market order for 73046 shares

2011-07-25 00:00:00 strategy [INFO] Buy order 3 updated - Status: SUBMITTED

2011-07-26 00:00:00 strategy [INFO] Buy order 3 updated - Status: ACCEPTED

2011-07-26 00:00:00 broker.backtesting [DEBUG] Not enough cash to fill yhoo order [3] for 73046 share/s

2011-07-26 00:00:00 strategy [INFO] Buy order 3 updated - Status: CANCELED

2011-07-27 00:00:00 strategy [INFO] Placing buy market order for 73610 shares

2011-07-27 00:00:00 strategy [INFO] Buy order 4 updated - Status: SUBMITTED

2011-07-28 00:00:00 strategy [INFO] Buy order 4 updated - Status: ACCEPTED

2011-07-28 00:00:00 broker.backtesting [DEBUG] Not enough cash to fill yhoo order [4] for 73610 share/s

2011-07-28 00:00:00 strategy [INFO] Buy order 4 updated - Status: CANCELED

2011-07-28 00:00:00 strategy [INFO] Placing buy market order for 74074 shares

2011-07-28 00:00:00 strategy [INFO] Buy order 5 updated - Status: SUBMITTED

2011-07-29 00:00:00 strategy [INFO] Buy order 5 updated - Status: ACCEPTED

2011-07-29 00:00:00 broker.backtesting [DEBUG] Not enough cash to fill yhoo order [5] for 74074 share/s

2011-07-29 00:00:00 strategy [INFO] Buy order 5 updated - Status: CANCELED

2011-07-29 00:00:00 strategy [INFO] Placing buy market order for 76335 shares

2011-07-29 00:00:00 strategy [INFO] Buy order 6 updated - Status: SUBMITTED

2011-08-01 00:00:00 strategy [INFO] Buy order 6 updated - Status: ACCEPTED

2011-08-01 00:00:00 broker.backtesting [DEBUG] Not enough cash to fill yhoo order [6] for 76335 share/s

2011-08-01 00:00:00 strategy [INFO] Buy order 6 updated - Status: CANCELED

2011-08-01 00:00:00 strategy [INFO] Placing buy market order for 76335 shares

2011-08-01 00:00:00 strategy [INFO] Buy order 7 updated - Status: SUBMITTED

2011-08-02 00:00:00 strategy [INFO] Buy order 7 updated - Status: ACCEPTED

2011-08-02 00:00:00 strategy [INFO] Buy order 7 updated - Status: FILLED

2011-09-15 00:00:00 strategy [INFO] Placing sell market order for 76335 shares

2011-09-15 00:00:00 strategy [INFO] Sell order 8 updated - Status: SUBMITTED

2011-09-16 00:00:00 strategy [INFO] Sell order 8 updated - Status: ACCEPTED

2011-09-16 00:00:00 strategy [INFO] Sell order 8 updated - Status: FILLED

2012-02-17 00:00:00 strategy [INFO] Placing buy market order for 77454 shares

2012-02-17 00:00:00 strategy [INFO] Buy order 9 updated - Status: SUBMITTED

2012-02-21 00:00:00 strategy [INFO] Buy order 9 updated - Status: ACCEPTED

2012-02-21 00:00:00 broker.backtesting [DEBUG] Not enough cash to fill yhoo order [9] for 77454 share/s

2012-02-21 00:00:00 strategy [INFO] Buy order 9 updated - Status: CANCELED

2012-02-21 00:00:00 strategy [INFO] Placing buy market order for 78819 shares

2012-02-21 00:00:00 strategy [INFO] Buy order 10 updated - Status: SUBMITTED

2012-02-22 00:00:00 strategy [INFO] Buy order 10 updated - Status: ACCEPTED

2012-02-22 00:00:00 strategy [INFO] Buy order 10 updated - Status: FILLED

2012-06-29 00:00:00 strategy [INFO] Placing sell market order for 78819 shares

2012-06-29 00:00:00 strategy [INFO] Sell order 11 updated - Status: SUBMITTED

2012-07-02 00:00:00 strategy [INFO] Sell order 11 updated - Status: ACCEPTED

2012-07-02 00:00:00 strategy [INFO] Sell order 11 updated - Status: FILLED

2012-08-10 00:00:00 strategy [INFO] Placing buy market order for 82565 shares

2012-08-10 00:00:00 strategy [INFO] Buy order 12 updated - Status: SUBMITTED

2012-08-13 00:00:00 strategy [INFO] Buy order 12 updated - Status: ACCEPTED

2012-08-13 00:00:00 strategy [INFO] Buy order 12 updated - Status: FILLED

2012-10-23 00:00:00 strategy [INFO] Placing sell market order for 82565 shares

2012-10-23 00:00:00 strategy [INFO] Sell order 13 updated - Status: SUBMITTED

2012-10-24 00:00:00 strategy [INFO] Sell order 13 updated - Status: ACCEPTED

2012-10-24 00:00:00 strategy [INFO] Sell order 13 updated - Status: FILLED

Sharpe ratio: 0.71

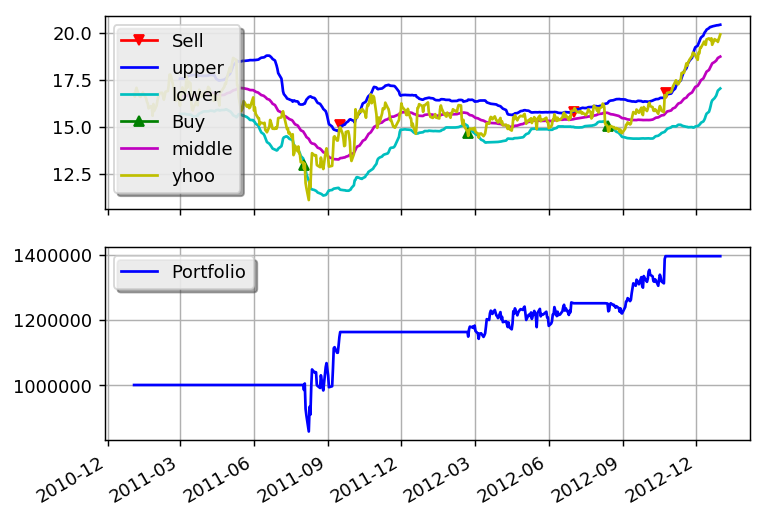

and this is what the plot should look like:

You can get better returns by tunning the Bollinger Bands period as well as the entry and exit points.